Micro Payment Ticketing Solution

RFCyber Micro Payment Ticketing (MPT) is a fast, convenient,

secure, and “one card for all” solution to issue electronic money (eMoney) for

micro-payment. MPT can be used for

ticketing in transit systems. It also can

be integrated with various industries to allow cardholders to do payment for

other transportation fares such as taxis, bus and railway, or for retail

merchant purchases such as fast food and convenient stores. Besides, RFCyber’s state-of-the-art secure

mobile technologies allow MPT purses to be issued not only via conventional way

to traditional cards but also via Over The Air (OTA) to mobile devices such as

NFC cell phones and micro SD. These

mobile purses can take advantages of the communication capability and

interactive user interfaces of the devices to provide additional services such

as OTA top-up, balance and history checking. To meet different business security needs, MPT purse can be issued using various popular

smart card standards such as Mifare, DESFire and CPU card (e.g., JavaCard).

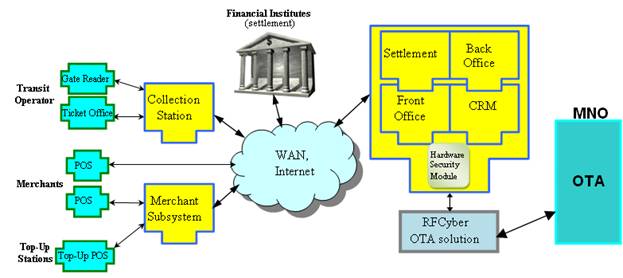

MPT Solution

Components

Benefits and Features of MPT Solution

This feature rich solution

provides a micro payment purse issuer with capabilities to securely and

reliably issue, trace and settle eMoney. By decoupling the backend system from the

front-end modules with open standards, the solution enables the eMoney issuer

to easily work with POS providers and RFID reader providers to support transit

operators, land-based merchants and web merchants to accept eMoney. By building both B2B and B2C concepts into the

system, it is a win-win solution such that various merchants and cardholders

can efficiently interact with the eMoney issuer. Moreover, interfacing with financial operators

is also supported to clear settlement in a timely fashion. If optional RFCyber OTA capabilities are added

to the solution, the issuer can work with Mobile Network Operator (MNO) to

include mobile features in their offers.

The productivity of the eMoney issuer is drastically increased as the

solution streamlines the enterprise workflow and enhances the issuer’s

interaction with all involved parties.

Front Office Daily customer service tasks are streamlined by an easy to use web based

card life cycle management module. The

features include personalized card issuance, card sales, lost card reporting,

card return and exchange tracking, and transaction archives retrieval. As part of the solution, a desktop tool is also included for fixing

inconsistencies on cards.

Back

Office The solution supports office operators’ daily tasks and administrative staff’s control

functions. The daily tasks include

return cards requests investigation, suspicious transactions investigation,

transaction adjustment, and blacklist maintenance. The

control tasks include Security and Authentication Module (SAM) card issuance

and operator card issuance. The solution

also includes a small batch issuance application.

Collection

Station The major task is to consolidate gate transactions and batch them to

backend for persistence and settlement. It

also works with backend to download blacklist and configuration information

such as fare structures to the gate readers.

Top-Up

Supports Three types of

card balance top-up method are supported: auto reload, web top-up, and

real-time top-up. Auto reload is to

automatically top-up cards that registered with a linked financial account when

their balances fall below a certain amount. Web top-up allows cardholders to virtually

request a top-up from a financial account via the internet and to physically

load the eMoney later on at designated locations. Real-time top-up enables self-service kiosk or

manned POS to perform instant top-up to cards.

Settlement

The main features

include batch transaction records validation, suspicious transaction records

detection, daily settlement, monthly settlement, and yearly settlement. It can

integrate with financial operators to clear settlement in a timely fashion.

Merchant

Subsystem The friendly web interface allows merchants to access current and

archived settlement reports, review transactions records and check daily

settlement status. It also enables

merchant headquarters to perform local settlement against its branches and to

only report consolidated transactions to central backend.

Customer Relationship

Management (CRM) Cardholders

are empowered with a web CRM to manage their cards via internet. For each card,

they can link a financial account, set up auto-reload, request for a web

top-up, and check archived transactions.