RFCyber Integrated Suite of Products

Deliver Results to Our Customers

RFCyber delivers on the promises of secured mobile

micro-payment by enabling the mobile operators and electronic money (eMoney) operators

to easily deploy their value-added solutions on mobile network. An integrated suite of server applications,

coupled with an open Trusted Service Management platform that promotes security

and operability, delivers multi-function smart card based services, including

micro payment for transit and retail merchants, mobile commerce and banking,

and mobile advertisement delivery.

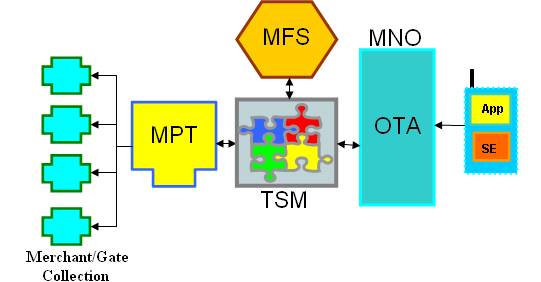

RFCyber’s end-to-end solution — a unique combination of products

including: the Micro Payment Ticketing (MPT) system that handles all the

operation regarding deploying a smart card based eMoney micro-payment system; the Trusted Service Management (TSM) platform

that handles all the life cycle management issue of the Secured Element (SE) in portable mobile devices; the Mobile Financial Service (MFS) platform

that provides the support for mobile phone based micro payment system including

Over-the-Air (OTA) application download and purse reload, combined with market

leading years of field deployment experience and client device expertise –

allows mobile operators and eMoney operators to quickly launch their new value-added

services or significantly improve user experience of their existing services.

Integrated Suite of RFCyber Products

Benefits of RFCyber Product Suite

Micro-Payment Ticketing (MPT) system provides a

state-of-the-art system architecture, enabling both on-line and off-line purse

consumption and reloading. Fault

detection and central clearing functions are supported with easy to use

graphical interface. Fare policy can be

easily implemented using the build in and/or custom fare structure. All the features are designed based on actual

deployment experience to simplify operation procedures and cost.

Trusted Service Management (TSM) manages the life-cycle of

the Secured Element (SE), either in the mobile phone or on a portable device

like USB dongles, micro-SD card. TSM

controls and executes your security policy by managing all the security keys

and certificates for the SE. With TSM,

the management of their current applications, and all other future applications

that will be downloaded into the SE, will be tremendously simplified.

Mobile Financial Service (MFS) is a set of key applications

for turning your customer’s handset into his personal financial

instrument. Inside MFS, an electronic

purse (ePurse) which is created based on PBOC 2.0 (People’s Bank Of China)

standard and could be customized based on your specific requirement, can be

consumed using RFID interface, or via mobile commerce interface. The ePurse can also be reloaded via the MFS

connection to the banking network. With

MFS, transaction records can be viewed through the handset instantaneously,

improving the user experience. MFS will

not only grow your customer’s loyalty, but will open more consumption channel

via mobile commerce, and new revenue channel via mobile advertisement.

Why Choose RFCyber as your Partner?

RFCyber was formed initially on developing RFID technology,

our expertise in this area is without question.

Our technology in RFID micro-payment was developed over more than 4

years period which encompassed both hardware and software technology, and field

deployment experience. Our products are

designed to be modular that can accommodate various deployment plans and

schedule. RFCyber is the first company

to provide OTA ePurse reloading, and we are also the first company to launch a

commercial deployment of our TSM and MFS products.

Our goal is to develop long term relationship with all our

customers, helping them to succeed in the project we both work together to

deploy. With our technology, products,

field experience and our commitment to customer success, RFCyber should be your

partner of choice in any of your electronic money micro-payment project.